Executive Summary: 6 Key Insights

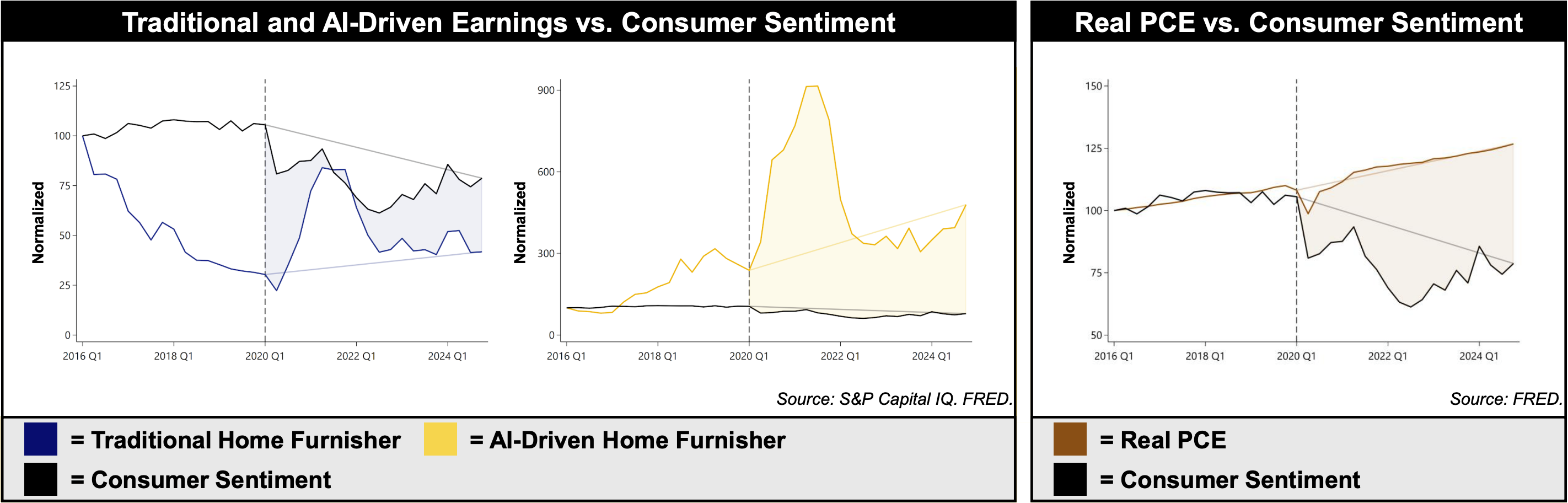

AI-Driven vs. Traditional Home Furnishers: Consumer Sentiment

- AI-Driven home furnishing companies are 87% and 85% less sensitive to shifts in consumer sentiment and housing market sales respectively, relative to Traditional peers (with results obtained through regression analyses).

- There is significant positive correlation between variations in consumer sentiment and Traditional home furnisher market performance.

- Consumer sentiment vs. personal consumption expenditure findings contradict the long-held belief that when “consumers feel good, they spend.”

Home Furnishings: An AI-Driven, Post-2020 Opportunity

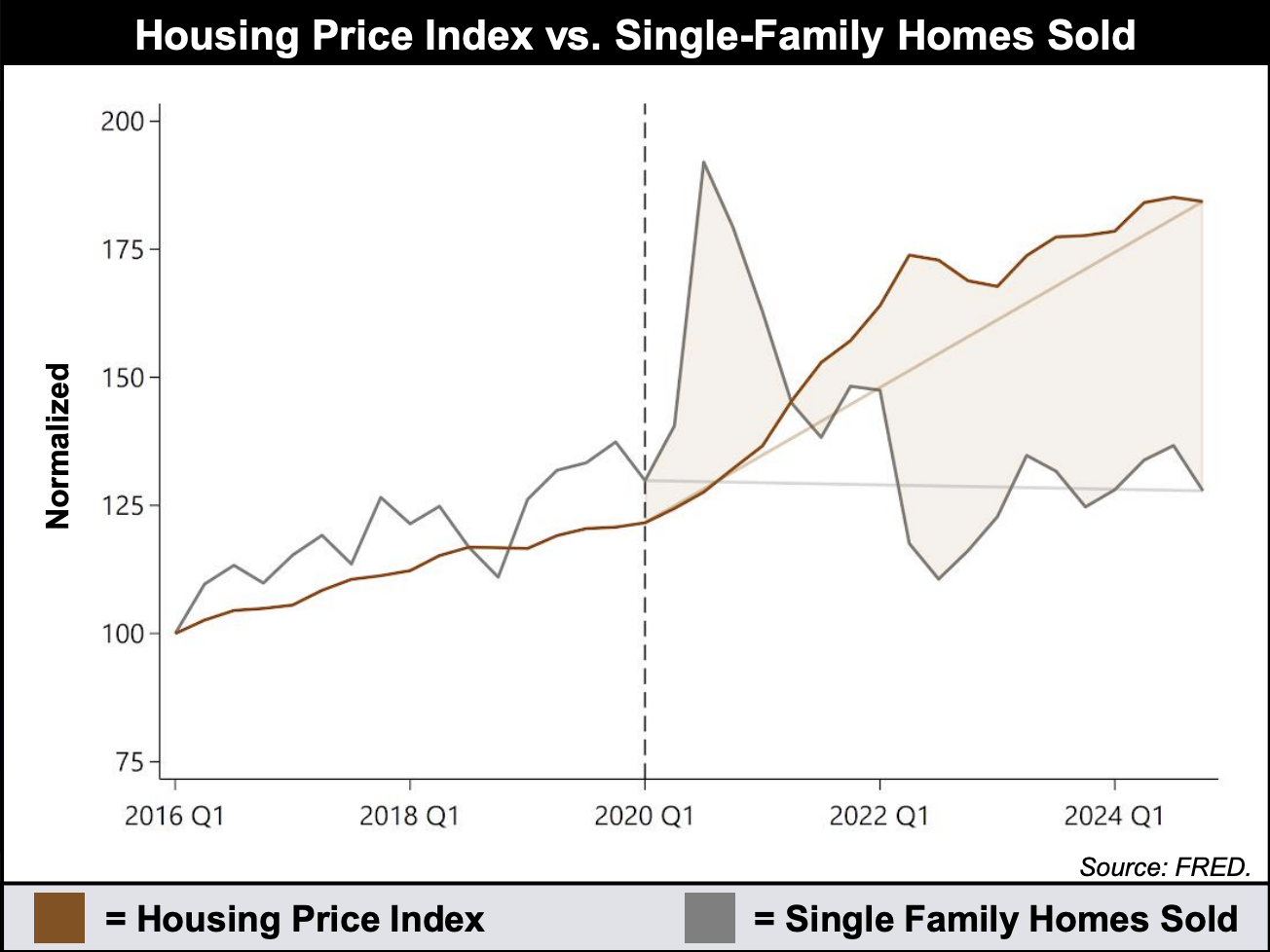

- Housing market dynamics drove increasing immobility for homeowners – a “locked-in” effect – incentivizing investment in already-owned homes over relocation.

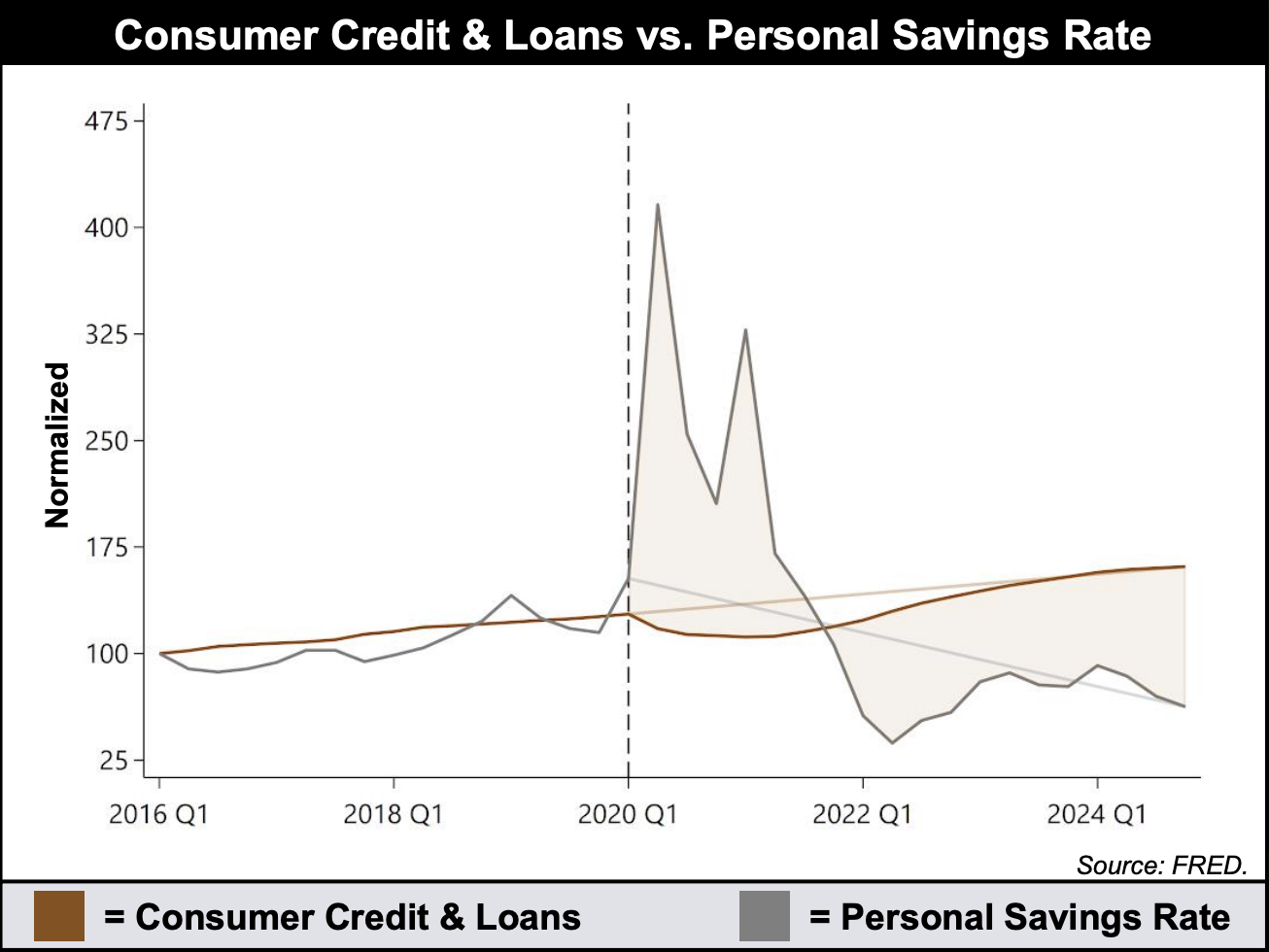

- Consumer financial profiles depict a recent trend of simultaneous increases in leveraged spending and decreases in personal savings.

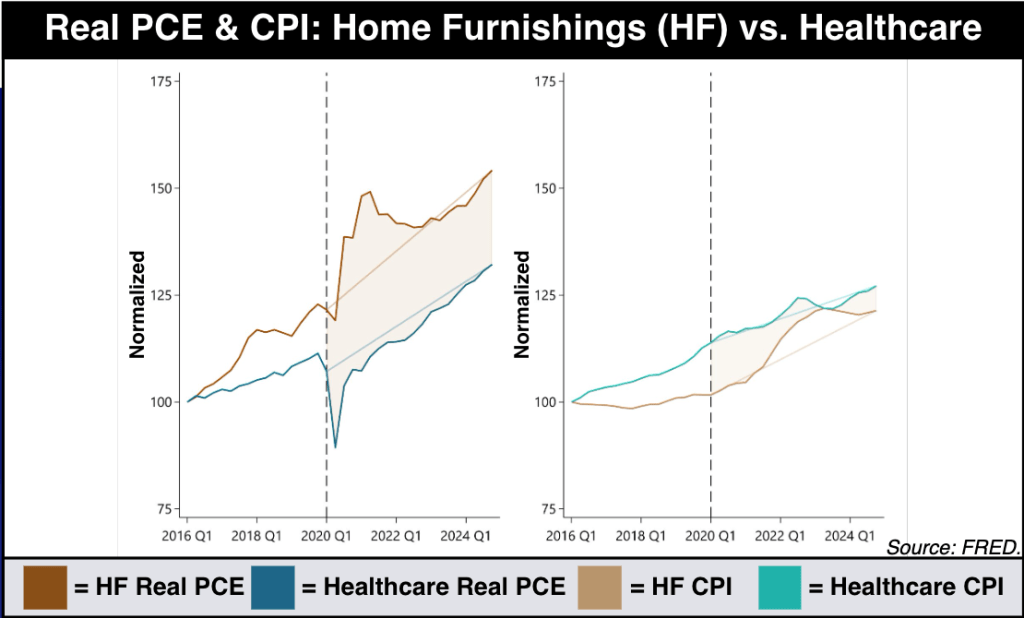

- Consumers are materially reprioritizing spending toward discretionary goods, like home furnishings, at substantially higher rates than necessities like food & healthcare.

Short-Post Structure

The integration of Artificial Intelligence (AI) within home furnishers enables the identification of Post-2020 thematic opportunities in housing markets & consumer behavior dynamics

| 1) Consumer Sentiment Dynamics on Al1 vs. Traditional2 Market Performance | 2) Post-2020 Consumer Financial Profiles & Housing Market Opportunities |

| “AI-Driven Independence From Sentiment Pressures” AI-Driven & Traditional Earnings vs. Consumer Sentiment “Weakening of a Decade-Long Correlation” Real PCE vs. Consumer Sentiment | “Recent Trends of Negligent Spending Habits” Consumer Credit & Loans vs. Personal Savings Rate “Systemic Immobility Prevalence in Homeowners” Single-Family Homes Sold vs. Housing Price Index “Material Reprioritization in Spending Allocations” CPI and Real PCE: Furnishings vs. Food & Healthcare |

Consumer Sentiment Dynamics

Post-2020, consumer sentiment plummeted to historic lows while real personal consumption expenditure (PCE) continued to rise, breaking a decade of economic correlation between how consumers feel & how much they spend

Traditional furnishers’ performance converges and correlates with post-2020 declining sentiment, while AI furnishers thrive. Regression analysis shows anti-cyclical features that insulate AI furnishers against periods of weak consumer confidence, where AI furnishers are 87% less sensitive to consumer sentiment than traditional counterparts.

New Consumer Post COVID-19

Toward the end of the COVID-19 pandemic, a fundamentally different consumer financial profile emerged: an archetype willing to deplete savings, while becoming more levered by utilizing increasing amounts of revolving credit and other consumer loans

Post-2020, savings rates collapsed from pandemic highs while revolving consumer credit and loan utilization steadily climbed.

This dramatic shift contributes to the explanation of persistent, robust, and real spending, despite declining sentiment, as consumers now finance consumption through a combination of their accumulated and potential savings, along with simultaneous draws on revolving credit lines and loans.

From Q1 2016 to Q1 2022, US revolving consumer credit (RCC), alone, was proportional to 95% of total domestic personal savings, on average. From Q2 2022 to Q4 2024, RCC was 157% of personal savings, increasing 1.67x.

Housing prices have surged since 2020, creating a “locked-in” effect where homeowners simultaneously possess increasing equity value while facing mobility constraints for new home purchases, incentivizing investments in current dwellings over relocation

The combination of these housing market dynamics incentivizes consumers to invest in their current dwellings, like home renovations or furniture, rather than purchase new homes. This has materialized in fewer single-family homes sold.

Regression analysis predicts AI-Driven furnishers to exhibit 85% less sensitivity to changes in housing market sales than their traditional counterparts.

From 2020-2022, on average, the amount of new single-family homes sold fell by 24%. The last comparable two-year decrease was from 2008-2010 during the housing market crisis, which had a decrease of 33%.

Real spending on home furnishings has dramatically outpaced necessities like food & healthcare, with consumers allocating increasingly more resources toward home improvements

PCE = Personal Consumption Expenditure

CPI = Consumer Price Index

Consumer spending reprioritization represents a fundamental budget allocation shift where discretionary spending growth on home investments now materially outpaces traditional necessities, indicating a novel structural shift in consumer behaviors.

The gaps between consumption expenditure growth on HF & both necessities widened significantly compared to the gaps of their respective price indices, suggesting these findings supersede attributions purely toward the relatively lower CPI growth in furnishings.

The AI Advantages & Other Considerations

Our Thoughts on the AI Advantage

Al furnishers leverage predictive analytics to identify emerging consumer behaviors and segments before they become apparent in traditional metrics, combined with using innovative payment solutions (e.g. BNPL) that perfectly align with new deficit-spending consumer profiles.

Al furnishers’ success stems from superior targeting and market expansion capabilities rather than changing fundamental price perceptions, allowing them to grow the total addressable market by identifying consumers willing to prioritize furnishings and home investments despite financial constraints.

Accordingly, regression analysis reveals Al retailers exhibit 2.35x greater sensitivity to furnishing-specific price increases than traditional counterparts, suggesting their competitive advantage lies in conversion optimization rather than price insulation – a vulnerability that reflects their success in capturing the more price-elastic, credit-dependent consumer segment that drives their overall market dominance.

About the Analysis

The analysis in this post was based on …

Geographic Scope: US data

Timeframe: Jan. 1, 2016 – Dec. 31, 2024

AI vs. Traditional Analysis:

AI-Driven Home Furnishers: group of 5 leading home furnishing companies that leverage AI for their business.

Traditional Home Furnishers: group of 7 comparable leading home furnishing companies that minimally leverage AI for their business.

Stay tuned for Short-Post #2, #3 and Deep Dive – Release Dates TBD